31+ cash coverage ratio calculator

Web Total Amount of Cash AvailableCurrent Liabilities Cash Coverage Ratio 200000180000 111 Using this calculation the cash coverage ratio is 111. Consider a company with the following information.

![]()

Online Stock Market Courses L Institute Of Stock Market L Internship 2018

Web Cash Coverage EBIT Non Cash ExpenseInterest Expense Calculation Examples Example 1 Lets say a firms total Operating Income EBIT for the given period is.

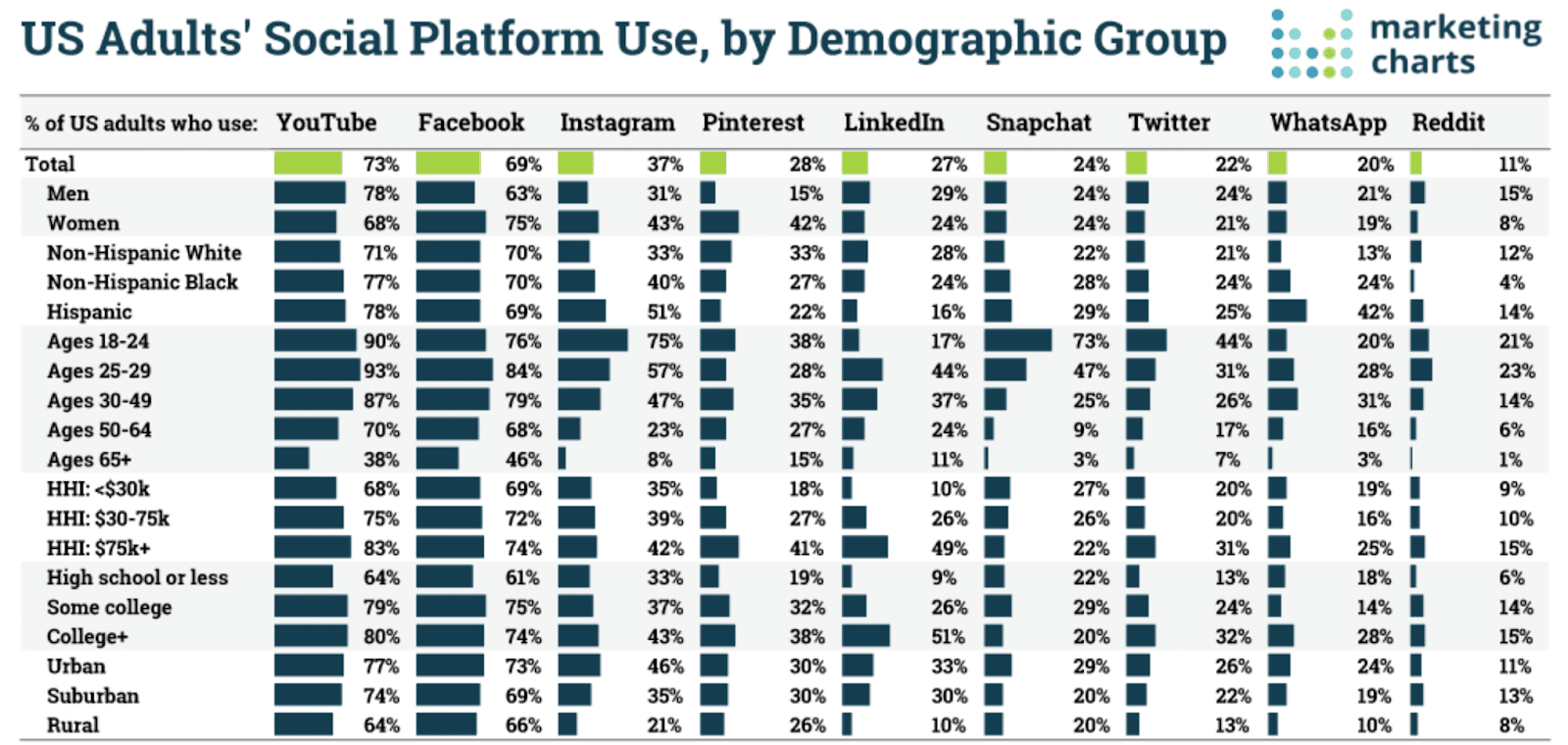

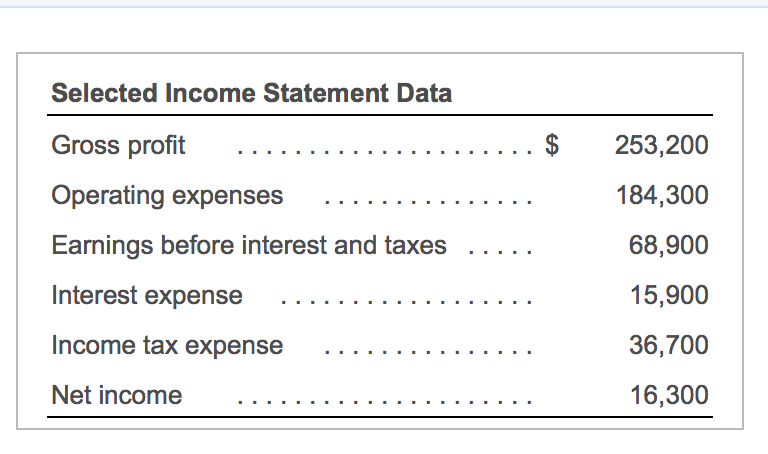

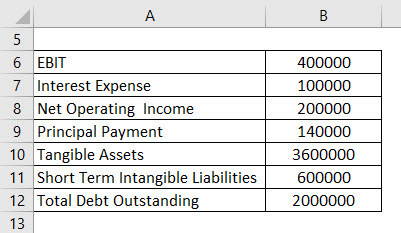

. In the final step we can now calculate the fixed charge coverage ratio by dividing the Covenant Adjusted. Web The calculation for the current cash debt coverage ratio is as follows. Web To calculate the cash coverage ratio take the earnings before interest and taxes EBIT from the income statement add back to it all non-cash expenses included in.

Web The coverage ratio calculator exactly as you see it above is 100 free for you to use. Web How to Calculate Asset Coverage Ratio Step-by-Step Higher asset coverage ratios imply lower financial risk associated with the borrower in question. If you want to customize the colors size and more to better fit your site then pricing starts.

Help your customers answer their personal financial questions from your website. Ad Enhance your Website with TCalc Financial Calculators. Web The formula to measure the cash debt coverage is as follows.

Create an interactive experience. Web The following equation can be used to calculate the interest coverage ratio of a business. Current cash debt coverage ratio operating cash flow current liabilities Why is it.

Earnings Before Interest and Taxes EBIT Depreciation Expense Interest Expense Cash. Web Formulae Total Cash Available With The Brand Current Liabilities Cash Coverage ratio Step-3- Analyze The Calculation After you get the figure of the cash. Web Cash flow coverage ratio 80000000 38000000 2105.

Additionally a more conservative approach is used to verify so the credit analysts calculate again using. Cash Coverage Ratio 40 million 10 million 25 million. Cash Debt Coverage Ratio Net Cash Provided By Operating Activities Total Debt.

Web The formula for calculating the cash coverage ratio is. Web Cash Coverage Ratio Cash Cash Equivalents Current Liabilities This ratio is also known as the cash to current liabilities ratio. The LLCR is calculated by.

Web Total Fixed Charges 225 million 4 million 625 million. ICR EBIT IE Where ICR is the interest coverage ratio EBIT is the. You can find the amounts of cash and.

Thats because it talks about liquid assets to. Web The cash Coverage ratio is one of the prescribed ratios. Web The loan life coverage ratio LLCR is a financial ratio used to estimate the solvency of a firm or the ability of a borrowing company to repay an outstanding loan.

Web Cash coverage ratio Total cash Total interest expense. So divide the net cash of the. Web Cash Coverage Ratio Earnings Before Interest and Taxes Non-Cash Expenses Interest Expense.

Financial Institutions look for a higher coverage ratio. Ordinarily earnings and other free. The asset coverage ratio determines if a companys liquidated assets can sufficiently cover its debt obligations and liabilities in case its earnings falter unexpectedly.

New General Mathematics 3 Pdf Equations Trigonometric Functions

Jaiib 2 Afb Quick Book Nov 2017 Pdf Interest Present Value

Cash Coverage Ratio Complete Guide Calculator

Page 5 Buildfire

Cash Ratio Or Cash Coverage Ratio Ccr Ratiosys

Solved Requirement 1 Calculate Patterson Inc S Debt Ratio Chegg Com

Cash Coverage Ratio Calculator Mathcracker Com

Cash Coverage Ratio Complete Guide Calculator

![]()

The Measure Of A Plan

Coverage Ratio Formula How To Calculate Coverage Ratio

Descriptive Statistics Of Interest Cover Ratio And Cash Interest Download Table

Acct3563 Notes Acct3563 Issues In Financial Reporting And Financial Analysis Unsw Thinkswap

What Is Cash Coverage Ratio How To Calculate It

Cash Coverage Ratio Calculator Calculator Academy

Current Cash Debt Coverage Ratio Formula Calculator Updated 2023

Cash Flow Coverage Ratio Calculator Efinancemanagement

S5z3rc6srbm2em